Linklaters has a series of Quick Guides that provide an overview of key sustainability disclosure regimes in the UK, EU and other jurisdictions. Click here to view all our Quick Guides.

This Quick Guide deals with the transition plan requirements under various mandatory, voluntary and proposed regimes.

Last updated on: 23 December 2025

| Transition plan requirements | |

| In a nutshell | There are various global, voluntary disclosure frameworks, developed by organisations such as the Taskforce on Climate-related Financial Disclosures (“TCFD”), the International Sustainability Standards Board (“ISSB”), the Transition Plan Taskforce (“TPT”) and the Glasgow Financial Alliance for Net Zero (“GFANZ”)), that cover disclosures relating to transition plans. In the EU, although the Corporate Sustainability Due Diligence Directive (“CSDDD” or “CS3D”), as amended by the Omnibus I changes, will no longer mandate the adoption of transition plans by in-scope companies, the Corporate Sustainability Reporting Directive (“CSRD”) still requires in-scope companies to disclose a transition plan if they have one. In the UK, the government is still deciding whether to make transition plans mandatory. |

| TCFD | The TCFD’s recommended disclosure on Strategy requires organisations to describe the impact of climate-related risks and opportunities on its businesses, strategy and financial planning. The TCFD Implementation Annex states that, as part of this disclosure, organisations that have made greenhouse gas (“GHG”) emissions reduction commitments, operate in jurisdictions that have made such commitments, or have agreed to meet investor expectations regarding GHG emissions reductions, should describe their plans for transitioning to a low-carbon economy. This description could include GHG emissions targets and specific activities that are intended to reduce GHG emissions in an organisation’s operations and value chain or to otherwise support the transition. While this envisages that organisations will need to provide forward-looking disclosures in relation to transitioning to a low-carbon economy, it does not equate to a requirement to adopt and publish a separate transition plan. The TCFD guidance on metrics, targets and transition plans recognises that transition plans include a wide range of information, all of which may not be appropriate to include in financial filings or other annual corporate reports. Therefore, the TCFD encourages organisations to disclose key information from their transition plans as part of their disclosure of climate-related financial information, including:

When describing their GHG emissions reduction targets, organisations should include the target dates as well as the scope and coverage. They should also consider explaining the assumptions, uncertainties and key methodologies used in relation to their transition plans. In addition, the TCFD encourages organisations to report annually on their progress in executing transition plans. The TCFD guidance also sets out the key characteristics of effective transition plans. For more information on the TCFD in general, see the TCFD Quick Guide. |

| ISSB | The ISSB’s climate disclosure standard - IFRS S2 - requires an entity to disclose both retrospective and forward-looking information about its response to climate-related risks and opportunities, including plans to achieve any climate-related targets. It does not require a preparer to produce a transition plan if it does not yet have one or to publish a transition plan where it has one. What it requires is the disclosure of certain information about how the preparer is preparing to transition. IFRS S2 is based on, and builds on, the TCFD Recommendations. IFRS S2, paragraph 14(a)(iv) (on strategy and decision-making disclosures), requires disclosure of “any climate-related transition plan the entity has, including information about key assumptions used in developing its transition plan, and dependencies on which the entity’s plan relies”. In June 2025, the ISSB published guidance on disclosures about transition plans (see here). The guidance is intended to support entities in applying IFRS S2. The ISSB guidance builds on the materials developed by the TPT (see below). The IFRS Foundation (which is responsible for the ISSB) took over responsibility for the TPT's disclosure-specific materials in 2024. Click here to access the TPT materials on the ISSB website. For more information on the ISSB in general, see the ISSB Quick Guide. |

| CSRD | The CSRD requires in-scope companies to disclose a transition plan for climate change mitigation, if they have one. Under the European Sustainability Reporting Standards (“ESRS”) - ESRS E1, Disclosure Requirement E1-1 - this needs to include, among other things:

If the company does not have a transition plan, it must disclose whether and, if so, when it will adopt one. EFRAG was working on draft Implementation Guidance on Transition Plans, but this work was put on pause in February 2025 in light of the Omnibus I package. The Omnibus I negotiations concluded in December 2025. Although the EU agreed to remove the transition plan requirements in the CSDDD (see below), the transition plan requirements in the CSRD remain unchanged. For more information on the CSRD and Omnibus, see the CSRD Quick Guide. |

| CSDDD | Article 22(1) of the CSDDD (as originally enacted) required EU Member States to ensure that in-scope companies adopt and put into effect a transition plan for climate change mitigation which aims to ensure, through best efforts, that the business model and strategy of the company are compatible with the transition to a sustainable economy and with the limiting of global warming to 1.5°C in line with the Paris Agreement and the objective of achieving climate neutrality as established in the EU Climate Law (Regulation (EU) 2021/1119), including its intermediate and 2050 climate neutrality targets, and where relevant, the exposure of the company to coal-, oil- and gas-related activities. Article 22(1) stated that the design of the transition plan for climate change mitigation shall contain:

Article 22(2) stated that companies that disclose a transition plan under the CSRD, or that are included in the plan of their parent which is disclosed under the CSRD, shall be deemed to have complied with the obligation to adopt a transition plan under the CSDDD (and therefore do not need to separately disclose for the purpose of compliance with CSDDD). Article 19 required the Commission to publish guidelines in due course providing practical guidance on the transition plan for climate change mitigation under Article 22. However, as part of the Omnibus I package, the EU has agreed to amend the CSDDD so as to remove all requirements relating to transition plans. The changes were agreed in December 2025. The requirements in respect of transition plans in the EU's CSRD remain (see above). For more information on the Omnibus changes to the CSDDD, see our video and blog post. For more information on the CSDDD in general, see our CSDDD materials. |

| TPT | The TPT was launched by the UK government in 2022 to develop a “gold standard” for climate transition plan disclosures for finance and the real economy. The aim was to develop best practice for credible and robust transition plans as part of annual reporting on business strategy. The IFRS Foundation (which is responsible for the ISSB) took over responsibility for the TPT's disclosure-specific materials in 2024 and the TPT has since been disbanded. In 2023, the TPT published the TPT Disclosure Framework (along with various guidance notes), which provides a set of good practice recommendations to help companies across the economy make high quality, consistent and comparable transition plan disclosures. The TPT Disclosure Framework is structured around three guiding principles:

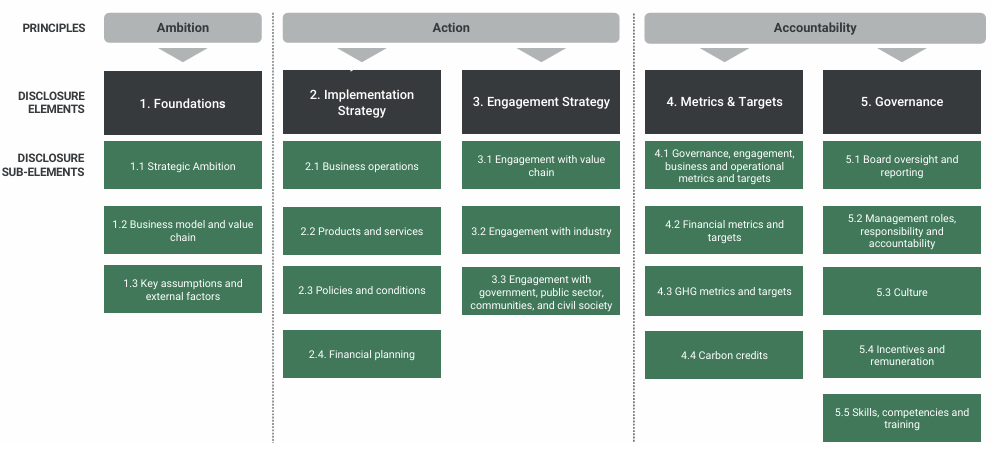

Those guiding principles are supported by five disclosure elements, which are divided into 19 sub-elements . The sub-elements are supported by a series of disclosure recommendations, phrased either as “shall” (where the TPT considers the disclosures as necessary for all good practice transition plans, subject to a materiality assessment) or “may”. See the figure below, taken from p.15 in the TPT Disclosure Framework.  The TPT Disclosure Framework aligns with the ISSB’s IFRS S2 as well the GFANZ transition plan guidance (see below). For more information on the TPT, see our client briefing: UK Transition Plan Taskforce publishes final recommendations on credible and robust climate transition plans. |

UK consultation on transition plans | On 25 June 2025, the UK government published a consultation on transition plans. The consultation closed on 17 September 2025. The Labour government committed in its manifesto to mandating “UK-regulated financial institutions (including banks, asset managers, pension funds and insurers) and FTSE 100 companies to develop and implement credible transition plans that align with the 1.5°C goal of the Paris Agreement”. The consultation sought views on each element of this commitment:

At this stage, the government is keeping all its options open. It has not yet decided whether to make transition plans mandatory and, if so, for which type of entities. It is considering the pros and cons of various options. The government has said it will consult again on the detail of any future obligations. Scope While the manifesto commitment referenced UK-regulated financial institutions and FTSE 100 companies, the government is considering whether to refine the scope of entities under any future transition plan requirement. However, the government is clear that it wants any future requirements to be proportionate and that the focus will be on economically significant entities (including pension funds) where there is likely a significant investor and public interest. As a result, small to medium-sized companies are not envisaged as being within the scope of any future requirements set by the government. Developing and disclosing a transition plan The government is considering two options:

Transition plan implementation The government is seeking views on whether to make implementation of transition plans mandatory, or whether current market mechanisms and investor pressure are sufficient to encourage companies to meet their targets. This option could possibly introduce a mandatory requirement on entities to deliver on the elements of their plan that are under their operational control. If the government pursues this option, it has indicated that it would take additional time to develop more detailed requirements and would work closely with industry to ensure implementation requirements are proportionate. Aligning transition plans to net zero by 2050 The government is consulting on design choices for potentially aligning transition plans to net zero by 2050, with interim (5-10 year) targets aligned with 1.5°C pathways. For more information on the consultation, see our blog post: UK government consults on transition plans: keeping its options open. |

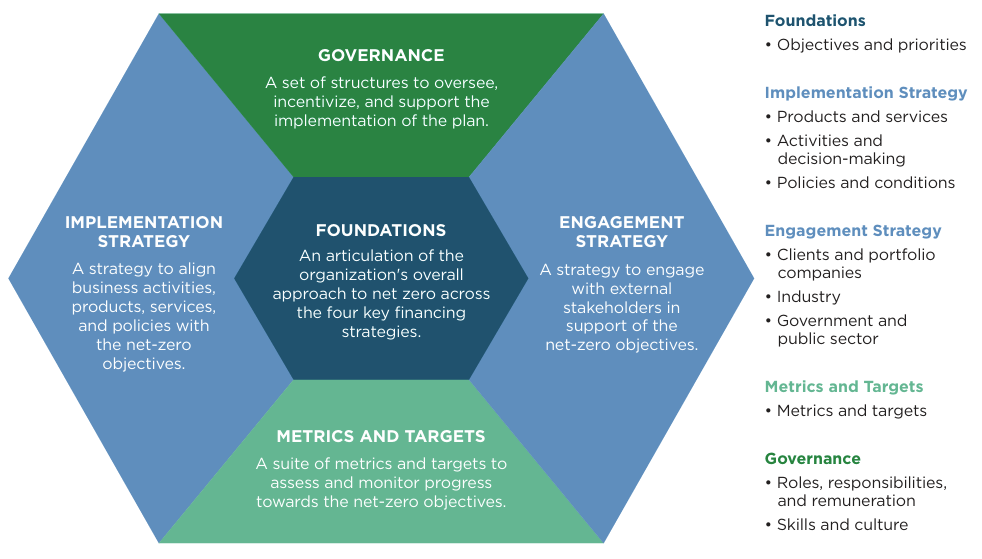

| GFANZ | GFANZ published a report on ‘Financial Institutions Net-zero Transition Plans: Fundamentals, Recommendations and Guidance’ in 2022. This report provides voluntary guidance to financial institutions in developing credible transition plans. The GFANZ report’s recommendations comprise ten core components that are grouped into five themes (see figure below, taken from p.22 of the GFANZ report):

Taken together, these components are designed to support financial institutions to develop a credible transition plan that is “actionable, measurable, with long-term targets but focused on near-term action, based on climate science, and against which there is accountability and transparency on underlying strategy and progress”.

|

| Linklaters materials | Linklaters transition plan materials |

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-01-28-14-47-21-400-697a2179e8715be98458d80a.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-02-26-14-43-35-040-69a05c17051641e74b399c07.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-02-26-14-28-53-246-69a058a552230663c9bb671a.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/MediaLibrary/Images/2025-01-15-13-59-32-056-6787bf44ab56ae4f199ac135.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-02-25-15-52-37-765-699f1ac5051641e74b2ac065.jpg)