Linklaters has a series of Quick Guides that provide an overview of key sustainability disclosure regimes in the UK, EU and other jurisdictions. Click here to view all our Quick Guides.

This Quick Guide deals with the recommendations and guidance produced by the Task Force on Climate-related Financial Disclosures (“TCFD”).

Last updated on: 5 September 2025

| Task Force on Climate-related Financial Disclosures (TCFD) | |

| In a nutshell | The TCFD was created in 2015 by the Financial Stability Board (“FSB”) to develop a voluntary, global framework for companies to disclose financial information about climate-related risks and opportunities, to help investors, lenders, and insurers make better capital allocation decisions and assess their financial exposure to climate change. The TCFD published its final recommendations in 2017 (updated in 2021), which became the gold standard for climate disclosures globally and a number of jurisdictions have decided to make disclosure in line with the TCFD Recommendations mandatory. The FSB asked the IFRS Foundation (which oversees the International Sustainability Standards Board (“ISSB”)) to take over the monitoring of the progress of companies’ climate disclosures from 2024 and so the TCFD was formally disbanded. The sustainability disclosure standards developed by the ISSB (IFRS S1 and IFRS S2) incorporate, and build on, the TCFD Recommendations. |

| Mandatory or voluntary? | Voluntary – but some jurisdictions (e.g. UK) have decided to adopt TCFD-aligned reporting requirements on a mandatory basis |

| Who does it apply to? | The TCFD Recommendations can be used by corporates, financial institutions and others. |

| When does it apply? | The TCFD Recommendations were published in final form in 2017 (updated in 2021) so have been available for use since then. Despite the TCFD having been disbanded, companies can continue to use the TCFD Recommendations should they choose to do so. Also, some companies may still be required to use the TCFD Recommendations if required under the relevant national laws (e.g. in the UK). |

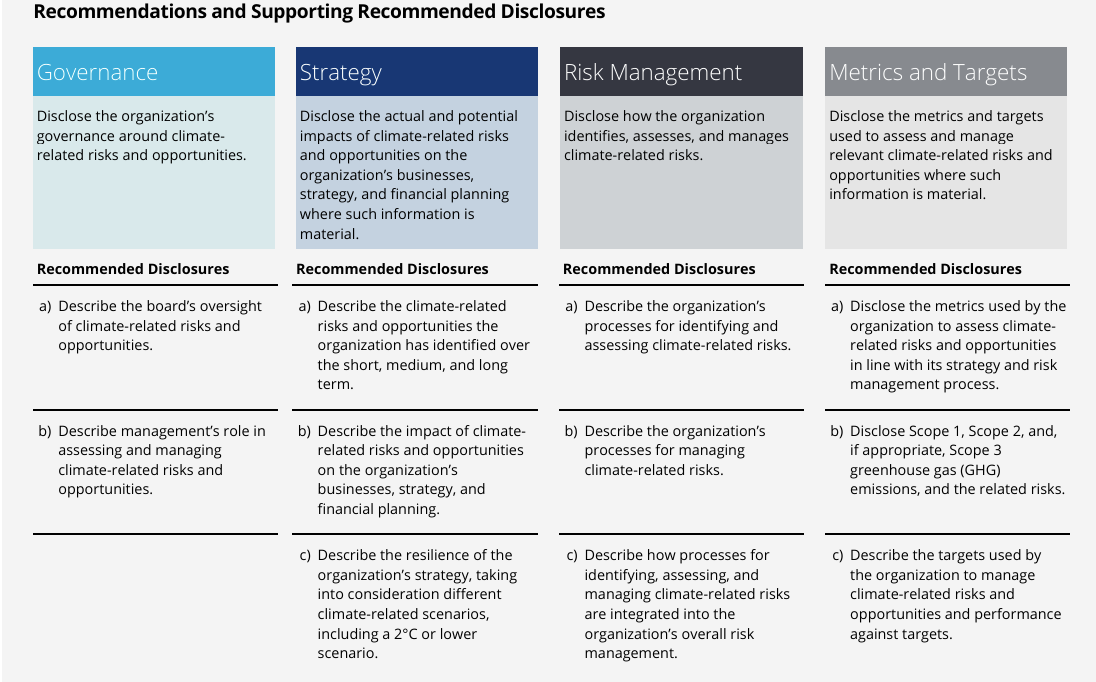

| What is required? | The TCFD recommends that preparers provide the climate-related disclosures in their mainstream (i.e. public) annual financial filings. The TCFD Recommendations are organised around four pillars:

There are 11 recommended disclosures for the 4 core recommendations – see image below on p.16 of the TCFD Recommendations.  The TCFD recommends (under the Metrics and Targets pillar) disclosure of Scope 1, Scope 2 and, if appropriate, Scope 3 greenhouse gas (“GHG”) emissions and the related risks. The guidance encourages all organisations to consider disclosing Scope 3 emissions. Information on historic GHG emissions should also be provided to allow for trend analysis. The TCFD Recommendations are accompanied by guidance for all sectors and supplemental guidance for certain sectors (i.e. for the financial sector and the non-financial sectors potentially most affected by climate change). See “Key documents” below. The TCFD has developed the following principles for effective disclosure of climate-related financial reporting:

These principles are described in more detail in Appendix 3 to the TCFD Recommendations. |

| Materiality | The TCFD Recommendations have a financial materiality focus and so are designed to provide useful to investors, lenders, and insurance underwriters climate data that is clear, reliable and comparable. In determining whether information is material, the TCFD believes organisations should determine materiality for climate-related issues consistent with how they determine the materiality of other information included in their financial filings. |

| Scenario analysis | The TCFD recommends that all organisations exposed to climate-related risks should consider:

The TCFD recognises that, for many organisations, scenario analysis is or would be a largely qualitative exercise. However, organisations with more significant exposure to transition / physical risk should undertake more rigorous qualitative and, if relevant, quantitative scenario analysis, which would include disclosing key assumptions and pathways relating to their chosen scenarios. The TCFD recommends organisations use a 2°C or lower scenario, in addition to two or three other scenarios most relevant to their circumstances, such as scenarios related to Nationally Determined Contributions (“NDCs”) required under the Paris Agreement that set out a country's objectives to reduce GHG emissions, physical climate-related scenarios, or other challenging scenarios. Organisations may decide to use existing external scenarios and models (e.g. those provided by third-party vendors) or develop their own, in-house modelling capabilities. For more detail, see the TCFD Guidance on Scenario Analysis for Non-Financial Companies. |

| Transition plans | The TCFD recommended disclosure on strategy requires organisations to describe the impact of climate-related risks and opportunities on its businesses, strategy and financial planning. The TCFD Implementation Annex states that, as part of this disclosure, organisations that have made GHG emissions reduction commitments, operate in jurisdictions that have made such commitments, or have agreed to meet investor expectations regarding GHG emissions reductions, should describe their plans for transitioning to a low-carbon economy This description could include GHG emissions targets and specific activities that are intended to reduce GHG emissions in an organisation’s operations and value chain or to otherwise support the transition. While this envisages that organisations will need to provide forward-looking disclosures in relation to transitioning to a low-carbon economy, it does not equate to a requirement to adopt and publish a separate transition plan. The TCFD guidance on metrics, targets and transition plans recognises that transition plans include a wide range of information, all of which may not be appropriate to include in financial filings or other annual corporate reports. Therefore, the TCFD encourages organisations to disclose key information from their transition plans as part of their disclosure of climate-related financial information, including:

When describing their GHG emissions reduction targets, organisations should include the target dates as well as the scope and coverage. They should also consider explaining the assumptions, uncertainties and key methodologies used in relation to their transition plans. In addition, the TCFD encourages organisations to report annually on their progress in executing transition plans. The TCFD guidance also sets out the key characteristics of effective transition plans. |

| TCFD vs ISSB | As mentioned above, the ISSB standards (IFRS S1 and S2) incorporate, and build on, the TCFD Recommendations. So, a company applying IFRS S2 will provide all of the information covered by the TCFD Recommendations. However, there are additional requirements in IFRS S2. These include the requirements for companies to disclose industry-based metrics, to disclose information about their planned use of carbon credits to achieve their net emissions targets and to disclose additional information about their financed emissions. The IFRS Foundation has published a comparison of the requirements in IFRS S2 and the TCFD Recommendations. |

| Other information | The IFRS Foundation is now responsible for monitoring the progress of companies’ climate disclosures, including under the TCFD Recommendations and ISSB standards. In November 2024, the IFRS Foundation issued a report on progress on corporate climate-related disclosures. The report examines disclosures made by public companies in five regions spanning eight industries. Key takeaways include:

|

| Key documents |

|

| Linklaters materials | |

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-01-28-14-47-21-400-697a2179e8715be98458d80a.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-02-20-10-35-24-559-699838ec3c0e09083e896237.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-02-16-14-22-13-733-69932815992cd855484327d9.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/MediaLibrary/Images/5f7321298cb62a11c00167af/2021-10-01-10-59-44-607-6156ea20f1267f0fc0984607.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-02-12-13-09-18-900-698dd0fe2b7f0a6b7ced47e9.jpg)