Linklaters recently commissioned Censuswide to conduct an online survey of 302 fund and portfolio managers who invest in the energy & utilities or infrastructure/transport sectors in the UK, France, Germany, Italy, Spain, Belgium, The Netherlands and Luxembourg. The fund managers polled have over £1 trillion of assets under management.

Key findings

Key findings of the survey reveal that:

- climate-resilient real estate and electric vehicles are the top green targets for European infrastructure funds - with the US, UK and Asia in line for a surge in investments;

- after growth potential, ESG credentials and transparency are the joint-second most important factors when managing portfolios; and

- Covid-19 has ‘rewritten the rules’ on risk management, with over 7 in 10 fund managers saying the pandemic has effected how they manage risk.

Looking at the results in more detail, they show that nearly a quarter of the investment fund managers polled expect to grow the proportion of green assets in their portfolios by up to 30% in the next two years:

- 23% said they would increase the share of green assets by 21%-30%, with a further two-thirds (63%) saying they will raise levels by 10%-20%. The findings demonstrate the significant role the infrastructure investment community is set to play in the ‘green recovery’ from the Covid-19 crisis.

- 72% (7 in 10) of those surveyed said that the Covid-19 crisis has affected their approach to the management of risk attached to high-impact, long-term unpredictable events.

The appetite for green is clearly growing and fast. But there is plenty of room for growth in this space, especially if we are to meet the ambitious global climate goals that have been set for the coming decades.

Funds are recognising the role they can play in the green recovery from the Covid-19 crisis and will be spurred on by upcoming EU regulations that embed ESG into investment decision-making, in particular the Sustainable Finance Disclosure Regulation, Taxonomy Regulation and Low-Carbon Benchmarks Regulation (see here).

Rush to green opportunities

Digital infrastructure is the sector which fund managers see the most opportunities as a result of the Covid-19 pandemic, with just under 40% (4 in 10) likely to invest, followed by renewable power (32%) and green infrastructure (24%) as popular sectors for investment.

When asked about their most likely future assets in the green space, green and climate-resilient real estate came top with over a third (36%) of fund managers planning such investments. Electric vehicles and its accompanying networks (35%) was the second most popular.

It comes as ESG credentials and transparency rank joint-second place (32%), after growth potential (36%), in the top three factors funds consider when managing their portfolio, highlighting the important role funds are giving to sustainability in their investments.

Investors look to US, UK and Asia

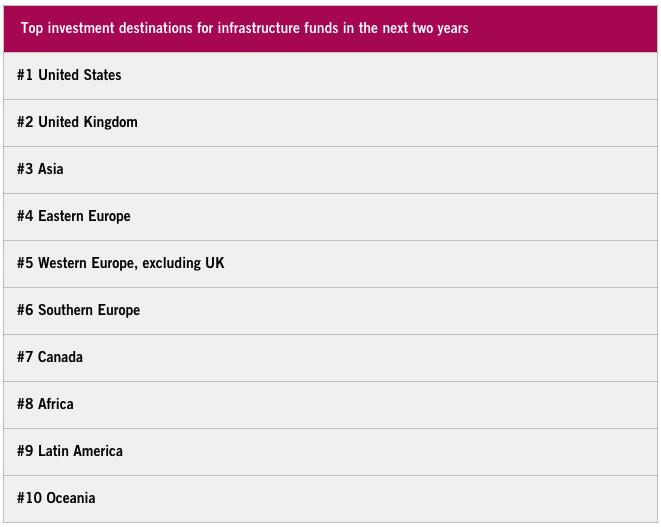

The US is the most attractive destination for infrastructure investment funds, with over 42% (4 in 10) of those polled including it in the top three geographies they will invest in over the next two years.

The UK follows closely behind, (31%) as does Asia (24%).

Meanwhile, around a fifth of respondents see opportunities in Eastern Europe (21%), Western Europe (21%) and Southern Europe (19%).

‘Clock is ticking’ on regulatory changes

The research also highlights the task ahead for funds as they prepare for the upcoming EU disclosure requirements. From March 2021, EU-regulated funds will be required, under the Sustainable Finance Disclosure Regulation, to disclose their approach to taking positive and adverse ESG impacts into account in investment decision-making.

Out of those surveyed, just over half (53%) were aware of these requirements, with a third (34%) unaware and a further 13% not sure.

The EU disclosure requirements are due to come into force in just over seven months. For those funds that are not yet across the detail, the clock is ticking, and they will need to move quickly to ensure compliance. For more information on the EU Sustainable Finance Disclosure Regulation, read our briefing on the Client Knowledge Portal.

For more information on the key trends and challenges surrounding ESG for infrastructure funds, implications of different ESG ratings and ESG considerations in the investment cycle and credit ratings considerations, see here.

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-01-28-14-47-21-400-697a2179e8715be98458d80a.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-03-04-17-03-55-254-69a865fb624f157c10d67faa.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-03-03-14-30-45-111-69a6f095c7461d828dddbd66.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/SearchServiceImages/2026-03-03-14-20-37-904-69a6ee35065b8520dc9351bd.jpg)

/Passle/5f6c57568cb62a0d7c9eadee/MediaLibrary/Images/2025-12-12-07-35-39-125-693bc5cb59393de31612a4f9.jpg)